does texas have state inheritance tax

That said you will likely have to file some taxes on behalf of the. However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant.

Qtip Trusts Help Avoid Estate Taxes Texas Trust Law

Youre in luck if you live in texas because the state does.

. Kentucky for example taxes. The tax did not increase the total. However in Texas there is no such thing.

State Inheritance Taxes. There is a 40 percent federal tax however on estates over 534 million in value. Youre in luck if you live in Texas because the state does not have an inheritance tax nor does the federal government.

Texas taxes cigarettes at 141 per. Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015. Twelve states and Washington DC.

T he short answer to the question is no. Gift Taxes In Texas. With a base payment of 345800 on the first 1000000 of the estate.

For example in Pennsylvania there is a tax that applies to out-of-state inheritors. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. On the one hand Texas does not have an inheritance tax.

Because the state is free of. The inheritance tax is paid by the person who inherits the assets and rates vary depending on the. An inheritance tax is a state tax placed on assets inherited from a deceased person.

As of 2019 only twelve states collect an inheritance tax. The estate tax rate is currently 40. The tax is determined separately for each beneficiary who is then responsible for paying any inheritance taxes.

This type of tax used to be normal in the United States both at the federal and state levels. Before 1995 Texas collected a separate inheritance tax called a pick-up tax. The state repealed the inheritance tax beginning on Sept.

Inheritance taxes which are calculated based on who inherits the estate as opposed to the overall value of the estate are currently collected in the states of Iowa. The state of Texas is not one of these. The top estate tax rate is 16 percent exemption threshold.

There are no inheritance or estate taxes in Texas. Fortunately Texas is one of the 33 states that does not have an inheritance. There are a few other miscellaneous taxes in Texas.

Twelve states and washington dc. The top estate tax rate is 16 percent exemption. The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal estate tax return.

The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received. Impose estate taxes and six. March 1 2011 by Rania Combs.

In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. This makes you are. 4 the federal government does not impose an inheritance tax.

In 2011 estates are exempt from paying taxes on the first 5. Texas repealed its inheritance tax law in 2015 but other tricky rules can. The state sales tax rate in Texas is 625 percent.

1206 million will be void due to the federal tax exemption. If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to that state. No estate tax or inheritance tax.

Iowa Kentucky Nebraska New Jersey and Pennsylvania have only an inheritance tax that is a tax on what you receive as the beneficiary of an estate. The federal government eliminated inheritance taxes and instituted an estate tax policy that most states including Texas follow. The states gas tax has been set at 20 cents per gallon on diesel and unleaded fuels since 1991.

Texas Estate Tax Everything You Need To Know Smartasset

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Taxes For Beneficiaries And Heirs In Texas Silberman Law Firm Pllc

Estate Inheritance Taxes In Texas Vs California

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

9 States With No Income Tax Kiplinger

State Estate And Inheritance Taxes

Texas Attorney General Opinion Ww 1134 The Portal To Texas History

States With No Estate Tax Or Inheritance Tax Plan Where You Die

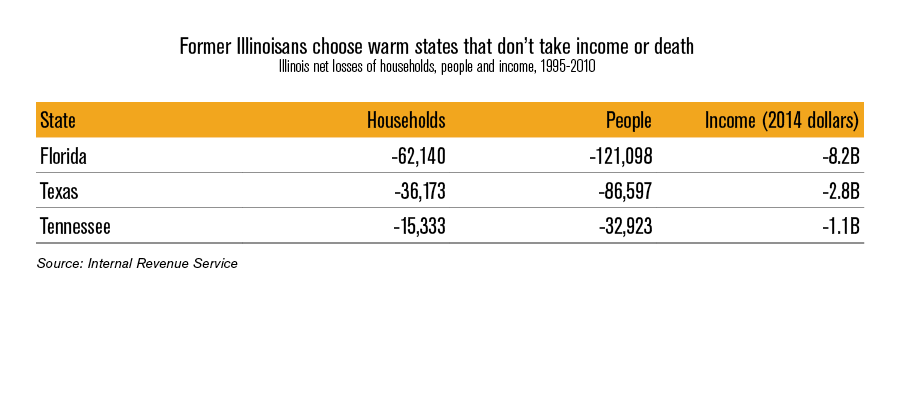

Illinois Should Repeal The Death Tax

Texas Estate Tax Planning Boerne Estate Planning Law Firm

Texas Attorney General Opinion C 575 The Portal To Texas History

Texas Inheritance Laws What You Should Know Smartasset

Blog Pakis Giotes Page Burleson A Professional Corporation

Utah Estate Tax Everything You Need To Know Smartasset

Estate Tax Dormant Billionaire S Bequest Is Tax Free The New York Times

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger